China’s new individual income tax law was passed in August 31st and it introduces many changes to the tax calculation and enforcement. In general, lower- and middle-income earners will profit from it, but high-income earners and (possibly) foreigners face higher taxes.

In the following, you can find the most important effects of the new law.

Positive effects for lower and middle-income earners:

The standard deduction will be raised to 5,000 Yuan per month, under the old law it was 3,500 for tax residents and 4,800 for non-residents.

Special deductions are added for items such as: caring for the elderly, children’s and continuing education, treatment for serious diseases, as well as housing loan interest and rent.

Charity is now deductible (if not exceeding 30 percent of the person’s income).

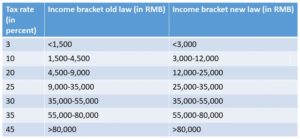

Lower and middle-income earners profit from tax cuts, as their income brackets have been widened:

Income categories have been simplified, the progressive tax rate now applies to income derived from labor services, author remuneration and royalties (these categories all fall under comprehensive income). In the old law, a flat, 20 percent rate applied for those categories.

Negative effects for high-income earners and foreigner:

Several changes in the new law will or could lead to higher taxes for high-income earners, for example, the formerly favorable tax policies on year-end bonuses could be scrapped or for several tax items (such as remunerations or royalties) were there was a flat 20 percent rate before, the progressive 3-45 percent rate will now apply. More information about this subject can be found here.

In the past, foreigners living for less than 5 consecutive years in China were not considered a tax resident (five-year-rule) and only had to pay taxes for income received inside China. But under the new law, it seems that everyone living for an accumulated 183 days or more of a year in the country will be considered a tax resident and must pay taxes for his/her worldwide income. This part of the law hasn’t been formulated clearly yet though and it is unclear if the five-year rule really will be abandoned.

In addition, tax authorities are given more powers to deal with tax evasion schemes.

Wondering how high your taxes will be? Calculate it with KPMG’s tax calculator.

[…] Smartinkblog | References: OECD, SinoSwiss, Chinatax, […]